If you are reading this article, you are probably curious whether or not you are on the right path with respect to your estate and financial plan. Over the 30 years of being in practice, we have built and executed thousands of estate plans. To help you better understand the key elements of an effective estate plan, we have created metrics to analyze our client’s plans and the resulting outcomes. Our goal is to define a successful estate planning process.

We have put together a six-part series in which we will address the overarching characteristics of a successful estate planning process. Over the next several months, we will break down each of the following parts of a well-constructed estate plan.

In a nutshell, the key elements that hold an effective estate plan together are teamwork, collaboration, and communication.

With that in mind, you are only as strong as your weakest link. Estate planning is an interactive process with mutual accountability. The most successful clients take an active role, delegate control, show a desire to understand and self-educate.

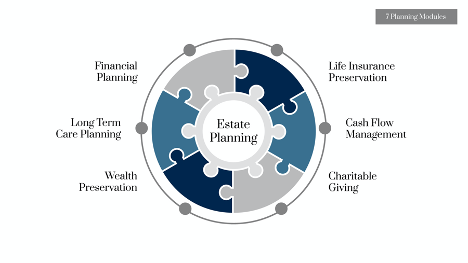

Our Estate Planning Modules:

Our firm has designed a Seven Module Estate Planning Process that begins with financial planning and ends with charitable giving.

As shown in the graphic below, each module is simply a piece of the estate planning puzzle, and each component complements the others.

Today, we begin with an overview of this six-part series:

1. Building a Road Map for Estate Planning and Financial success

A great estate plan begins with organization and clear direction. While it is essential to have your six basic estate planning documents completed, a superior estate plan encompasses your complete financial picture. This picture includes all aspects of how you wish to build a secure financial future for you and your loved ones.

As you begin building your estate plan, we follow the following action steps:

Create plan > Implement plan > Review plan > Make appropriate adjustments > Title assets properly for estate planning and asset preservation > Bring important life decisions to your advisors > Develop maintenance plan* (self-activated or driven by advisors)

*Ask about our concierge estate planning program

2. Team building: Building Your Estate Planning Team

One common factor across many of our successful case studies is the coordination with a proactive team of advisors. After building your estate and financial planning team, you must develop a strategy to create the glue for the team.

Who leads the team? Who organizes the team meetings? Who is responsible for creating communication between the team members?

Choosing the right team members can be a defining factor in the effectiveness of your planning process. Some of the critical factors to look for are: credentials, personal style, cohesive fit, ability to communicate.

We will also discuss the importance of measuring your team’s performance and making adjustments as needed. What are the best benchmarks and metrics to review and evaluate your team to make the appropriate shifts throughout the planning process?

3. Risk Management

Often clients ask what the differences are between things like risk management, asset preservation, or estate & financial planning. The industries can do a better job explaining these differences, however, it is important to also note the commonalities between each area of expertise. We will break down the different elements each team member may be responsible for, as well as the products and services that each offers.

Click here to take our Risk Management Self-Audit.

4. Core documents and essential components to a comprehensive plan

While estate planning can be complicated and even cumbersome at times, there are a small number of items that make up the backbone or the core of your plan. These are your six primary estate planning documents that spell out your wishes for the future and establish clear instructions for the others that will potentially be involved in decision making on your behalf.

In addition to the core documents, we will discuss ancillary matters including but not limited to umbrella insurance, long term care insurance, and family law documents such as post-nuptials and pre-nuptial agreements.

We will also address the use of the separate writing for the disposition of your tangible personal property. Finally, we will discuss the appropriateness of a letter of intent, bible/roadmap, ethical will, and funding instructions for implementation.

5. Customization of Trusts

Many times, a trust or multiple trusts are critical components of a successful estate plan. While there are many best practices available, as well as the most common trusts, choosing the appropriate trust structure for your situation is key to taking your plan to the next level.

Some of the items to consider are as follows: traditional vs. alternative trust provisions, unitrust, special needs trust, total discretionary trust, hybrid trust. We will also review the use of powers of appointment and trust protector provisions.

These custom trust structures allow for greater flexibility and control. Customization will allow you to make more explicit decisions that provide greater protection for your heirs.

6. Legacy component

While last on our checklist, the legacy component is undoubtedly one of the most important pieces of your plan. Many clients feel that they will deal with charitable giving as they go, on an annual basis, rather than incorporate it into their estate plan. However, charitable giving during your lifetime can provide enormous income tax savings that you may otherwise lose at the time of your passing.

A combination of multiple charitable giving techniques including cash gifts, planned gifts, including gifts to a donor-advised fund both during your lifetime and upon your death will supercharge your estate plan

Click here to read Part 1. If you have any questions in the interim, please do not hesitate to contact Wollman, Gehrke & Associates, or your other financial advisors.